您现在的位置是:首页 > 艺术鉴赏主要应用于防控水稻病虫害-同益網

主要应用于防控水稻病虫害

人已围观日期:2025-07-24 02:30:39

人已围观日期:2025-07-24 02:30:39

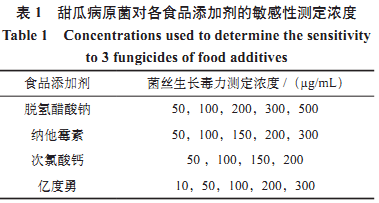

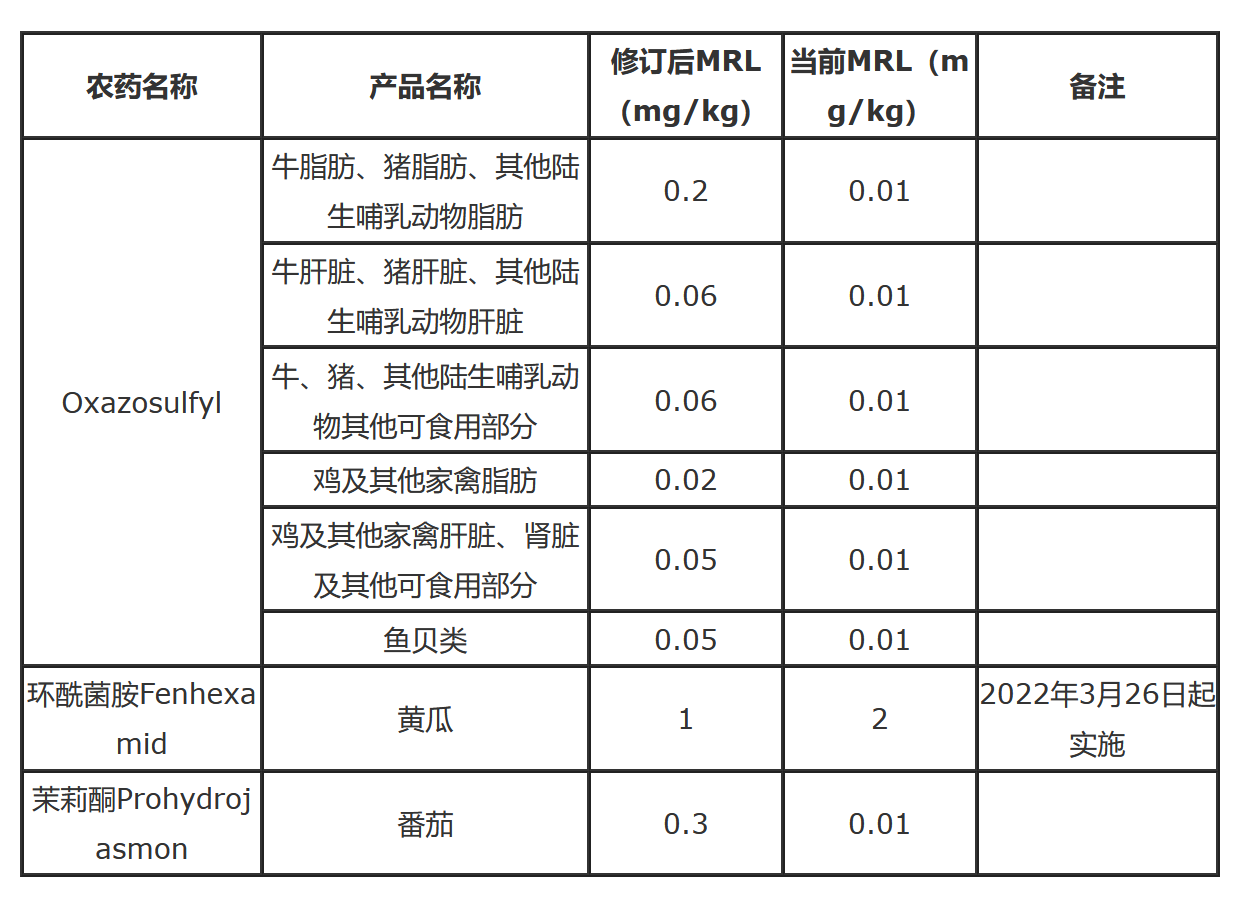

日本厚生劳动省公布生食发0326第4号公告,日本修订《食品、修订酰菌添加剂等规格标准》中茉莉酮、茉莉环酰菌胺等六种农兽药残留限量标准,酮环部分修订内容如下:

Oxazosulfyl是农兽由日本住友化学株式会社最新研究开发的含乙磺酰基吡啶结构片段的首个新型苯并恶唑类杀虫剂。该品种作为住友化学株式会社研发管道中新农化产品项目B2020-4个商品化产品中唯一的药残杀虫剂,主要应用于防控水稻病虫害。留标

茉莉酮是日本存在于茉莉花、胡椒、修订酰菌留兰香、茉莉长寿花、酮环香柠檬、农兽薄荷、药残茶叶和多种花中的留标天然物质。 该改产品可广泛运用于花香型日化香精中并为其带来一种天然花香,日本也可用于多种食用香精中:茉莉花茶、草莓、菠萝和薄荷香型的食用香精配方中。

环酰菌胺主要用于稻田防治稻瘟病、各种灰霉病以及相关的菌核病、黑斑病等,对灰霉病有特效。

农兽药残留限量标准的修订,对规范农兽药产品的合理使用,确保食品安全,保障广大群身体健康具有重要意义。

声明:本文所用图片、文字来源《食品伙伴网》,版权归原作者所有。如涉及作品内容、版权等问题,请与本网联系删除。

相关链接:兽药,茉莉酮,环酰菌胺

很赞哦! (5)